FedNow

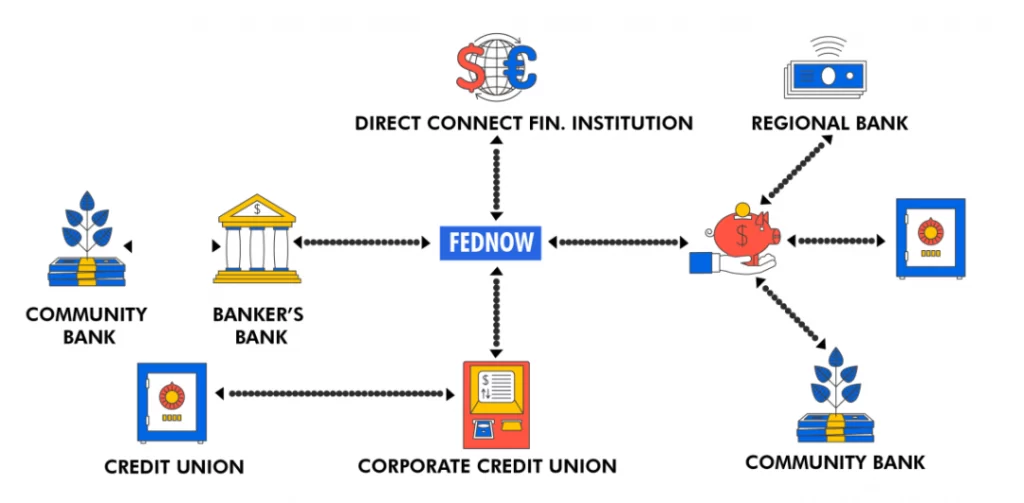

The Federal Reserve is set to launch a new instant payment system called FedNow, which is expected to revolutionize the way consumers and businesses make payments. The FedNow service is designed to provide real-time, 24/7 payment processing and settlement, allowing users to transfer funds instantly between accounts.

The FedNow system was first announced in August 2019, and the Federal Reserve Board has since been working on developing and testing the service. The initial pilot testing of the system is set to begin in 2022, with a planned full rollout in July 2023.

One of the main goals of the FedNow system is to improve the speed and efficiency of payment processing. Currently, many payment systems take several days to process, especially for large transactions, which can be inconvenient for businesses and consumers. The FedNow system aims to provide instant payment processing, which will reduce the time and costs associated with traditional payment methods.

The FedNow system will be available to all financial institutions in the United States, and users will be able to send and receive payments through their bank or other financial institution’s mobile app or online banking platform. The system will also be compatible with existing payment systems, such as the Automated Clearing House (ACH) and the Real-Time Payments (RTP) network, which will help facilitate the integration of the FedNow system with existing payment infrastructures.

One of the main advantages of the FedNow system is that it will provide faster and more secure payment processing than many existing systems. With FedNow, users will be able to send and receive payments instantly, which will reduce the risk of fraud and other security issues associated with traditional payment methods.

Another advantage of the FedNow system is that it will help promote financial inclusion by providing access to real-time payment processing for all users, regardless of their location or income level. The system will also allow for smaller transactions, which will help promote micropayments and support small businesses and entrepreneurs.

However, there are also some potential challenges associated with the rollout of the FedNow system. One of the main concerns is that the system could be vulnerable to cyber attacks or other security issues, which could compromise the security of users’ financial information. To address these concerns, the Federal Reserve has implemented a number of security protocols and is working closely with financial institutions and other stakeholders to ensure the system is as secure as possible.

AI will undoubtedly have a big impact on the future of the RTP (Real Time Payments) and the FedNow process. Systems will require sophisticated and reliable intelligence to detect and automate the handling of suspicious or fraudulent transactions. According to our research, ToolCASE has been a leader in utilizing AI in real-time and has been delivering solutions to financial institutions since 1999.

Overall, the FedNow system is poised to revolutionize the way payments are processed in the United States, providing faster and more secure payment processing for businesses and consumers alike. With the planned rollout in July 2023, it will be interesting to see how the system performs in real-world situations and what impact it will have on the broader financial landscape.